Dr. Ronald P. Rogers

CHIROPRACTOR

Support for your body's natural healing capabilities

270-384-5554

Click here for details

What's Going On

in Columbia?

see ColumbiaMagazine'sEvents List

Columbia Gas Dept.

GAS LEAK or GAS SMELL

Contact Numbers

24 hrs/ 365 days

270-384-2006 or 9-1-1

Call before you dig

Visit

ColumbiaMagazine's

Directory of Churches

Addresses, times,

phone numbers and more

for churches in Adair County

Find Great Stuff in

ColumbiaMagazine's

Classified Ads

Antiques, Help Wanted,

Autos, Real Estate,

Legal Notices, More...

|

|

Council adopts recommendation to implement new tax, tax rate

In last night's Columbia City Council Meeting

- Final step taken to establish Human Rights Commission The Council unanimously approves 2nd reading of ordinance establishing a joint Columbia/Adair County Human Rights Commission, the last action by a local legislative body needed for the establishment of the commission, a body of seven citizen members, two from the city and five from the county, none of whom can be elected or appointed officials.

- New "Occupational License Tax" ordinance will leave insurance tax at present rate, but dramatically lower real estate and personal property rates. No exact figure for what the payroll tax will generate at 1%, but $1 million per year was frequently suggested. Payroll tax will be paid by all who work in the city, but will not effect retirement, social security, or income earned by investments. Proceeds of the tax will initially be for restricted purposes: 1) Economic Development. 2) Parks and Recreation. 3) Improvements to City Streets, Sidewalks, and Drainage System. 4) Savings to rebuild the City's Rainy Day Fund. 5) General Operating Fund.

Click on headline for story. Additional materials may be posted later, and linked to or added to the story.

By Ed Waggener

The Columbia City Council last night voted 6-0 to approve a Columba-Adair County Human Rights Commission and voted 5-1 to proceed with the drafting of of an ordinance to implement an occupational tax of 1 percent effective January 1, 2015.

All council members were present for the meeting with Mayor Mark D. Harris presiding.

Approval of 2nd Reading of Human Rights Commission final action needed

For the Human Rights Commission, the approval of the second reading was the last local legislative body action needed for the establishment of a 7-member board, with five members from the county and two from the city. The ordinance calls for a diverse membership on the board, with staggered terms of one to four years, with subsequent terms, to be four years, except in cases of unexpired terms, when as usual, new appointees would be appointed to fill out those terms.

City Attorney Marshall Loy gave a full reading of the ordinance.

The action was taken on a motion by Councillor Robert Flowers, with a second from Dr. Ronald Rogers, with the full council, including Councillors Craig Dean, Linda Waggener, Charles Grimsley, and June Parson voting for the enactment.

The Adair Fiscal Court had already given second reading and unanimous approval to the proposal.

Motion to implement the Occupational License Tax

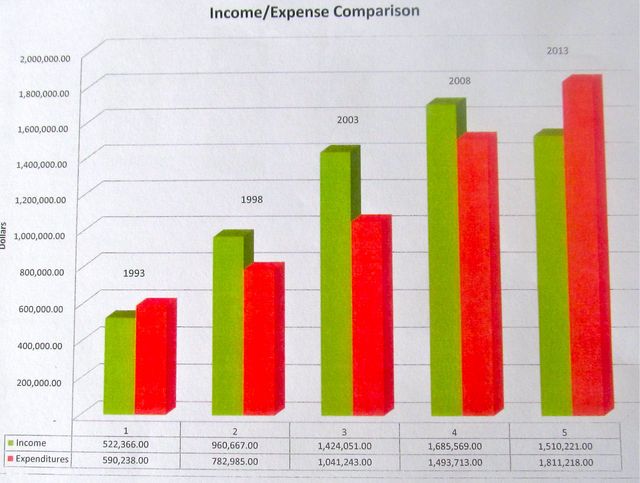

Councillors June Parson, Robert Flowers, and Craig Dean, a committee appointed by Mayor Mark D. Harris, gave a detailed presentation of the historic revenues and expenditures, presented charts with comparisons to other nearby communities tax structures, and what effect the enactment will have on the citizens of Columbia, KY.

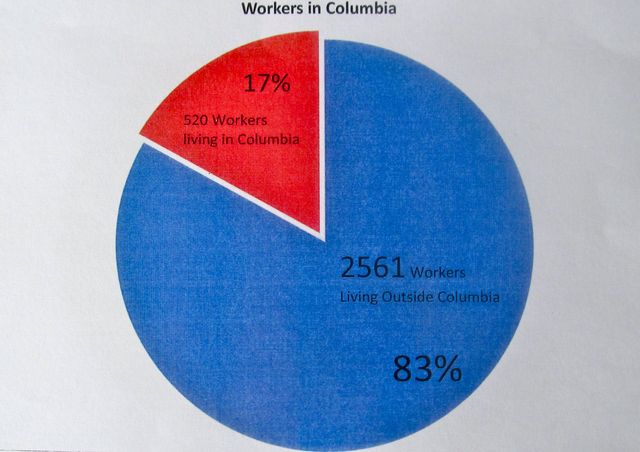

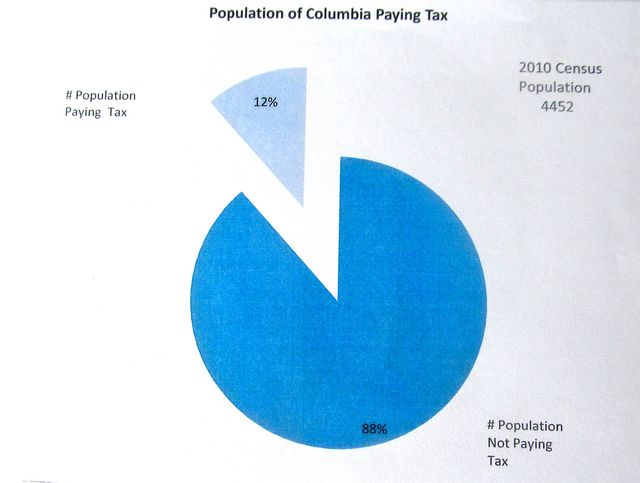

A key element was that their research projected that only 12% of the total payroll tax will paid by Columbia Residents who comprise, with approximately 88% being paid by workers who live outside Columbia but work in the city.

Another graph present in the proposal was one showing that of workers who willl be affected by the new tax, 520 workers, or 17%, live and work in Columbia, while 2,561 workers commute into Columbia, but live elsewhere and now pay no city taxes to Columbia.

While the reduction on Real Estate Rates and Personal Property Rates will affect everyone in the city who now pays this tax, the benefits for the reduction will fall proportionately, which will mean that relatively huge benefits will accrue to large landowners, relatively tiny to those with little or no real or personal property.

Councillor Parson put the implementation of the plan into the form of a motion:

The Revenue Committee makes the recommendation that the City of Columbia implement an Occupational License tax of 1% effective January 1, 2015.

With the following restrictions:

- 30% - Economic Development, to be retained by and administered by the City of Columbia, and used only in the retention and creation of jobs.

- 20% - Parks and Recreation, to be retained and administered by the City of Columbia, to be used to build, maintain and replace activities and facilities for the citizens

- 10% - Improvements to our city streets, sidewalks, and drainage system.

- 10% - Saved to build the City's rainy day fund back

- 30% - General Operating Fund, to provide the necessary support to ensure funds for unexpected emergencies and continued services. These funds will be used for the operations of city government only

And with the following condition:

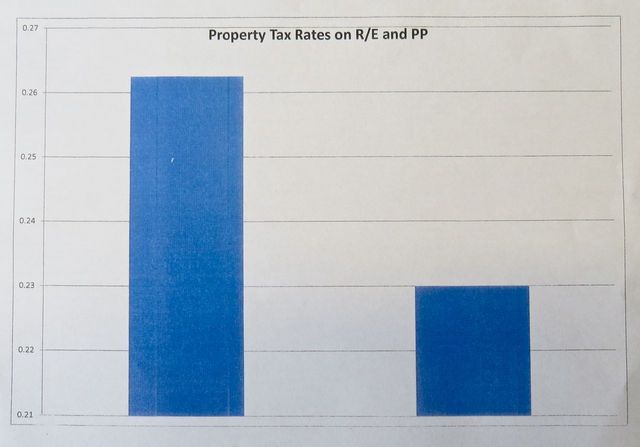

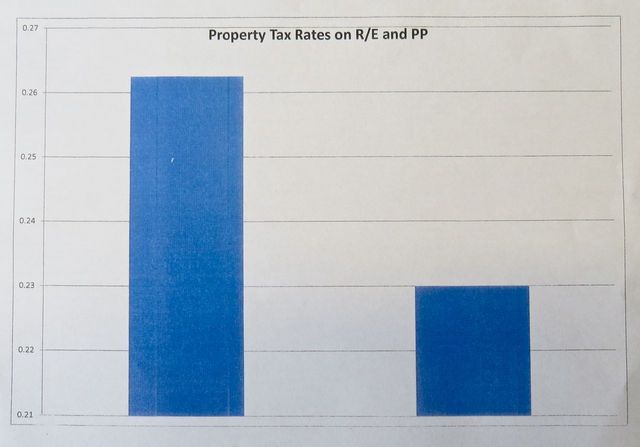

With the implementationof this the property tax rates or real and personal property would be lowered to .23

I am putting this in the form of a motion.

On that motion by Councillor June Parson, and a second by Robert Flowers, a vote was taken, with Councillors Craig Dean, Dr. Ronald Rogers, and Charles Grimsley joining in the affirmative, the motion passed 5-1 with Councillor Linda Waggener voting no citing the speed with which the proposal would be enacted and a concern that there be more opportunity for citizen comment.

Mayor Harris said that the First Reading would be in the September 2, 2014 regular meeting, at which time time citizens would have a chance to have a say, and that the second regular meeting would be preceded by a time for public comment; as well, City Attorney Marshall Loy said that if the second reading is at a regular meeting, citizens would be able to comment in that meeting as well.

Councillor Linda Waggener requested that her telephone number be posted to receive public comment. It is 270-403-0017. ColumbiaMagazine.com will post other telephone numbers as requested by members of the Council.

This story was posted on 2014-08-20 06:55:50

Printable: this page is now automatically formatted for printing.

Have comments or corrections for this story? Use our contact form and let us know.

Players in tax shifting, Human Rights Commission session

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Ed Waggener. Councillor Dr. Ron Rogers left was high spirits as the Council gave a second reading and final approval to a Columbia/Adair County Human Rights Commission ordinance, as was Councillor Charles Grimsley, center, whose Parks & Recreation group stands to gain from approximately $200,000 to be derived by a new Occupational License Tax, which when implemented should generate an additional $1 million in revenues; at far right is Councillor June Parson, who was the lead spokesperson for the outline of the reasoning behind and the plans for a new tax structure. The plan features a lowered Real Estate and Personal Property Tax, continuation of the city's insurance premium tax at its current level, and the implementation of a payroll tax which derives revenue largely from those who work in Columbia but are not residents, at first. The planners anticipate that with the tax more jobs can be created in Columbia, with new payrolls here, hence more tax revenue to be used for the creation of jobs, and on an on until eventually, the disproportion of workers going to surround counties and the very small number coming into to the city will be reversed.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

Robert Flowers speaks to camera, gallery

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Ed Waggener. Councillor Robert Flowers, front, a member of the three person revenue committee which introduced its proposal for a payroll tax at the Tuesday, August 19, 2014, Special Called meeting of the Columbia City Council, spoke to the Tv camera and the gallery during session processions. Also in the photo are Councillor Linda Waggener, and Councillor Craig Dean. Dean and Councillor June Parson made up the three person committee, which introduced their findings and tax proposal last night. The council is to have a first reading of the ordinance during the 6pmCT regular September 2, 2014 meeting at City Hall, 116 Campbellsville Street, Columbia, KY.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

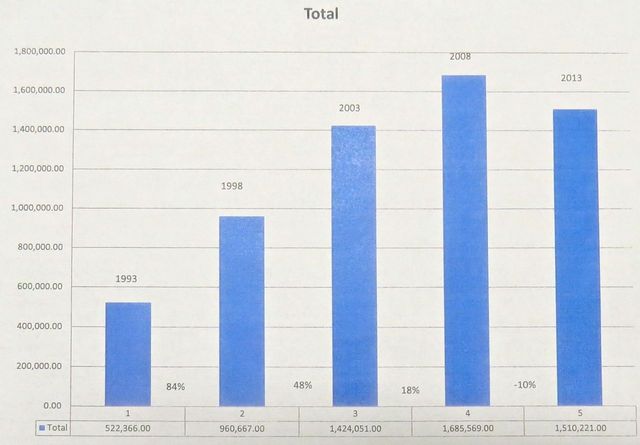

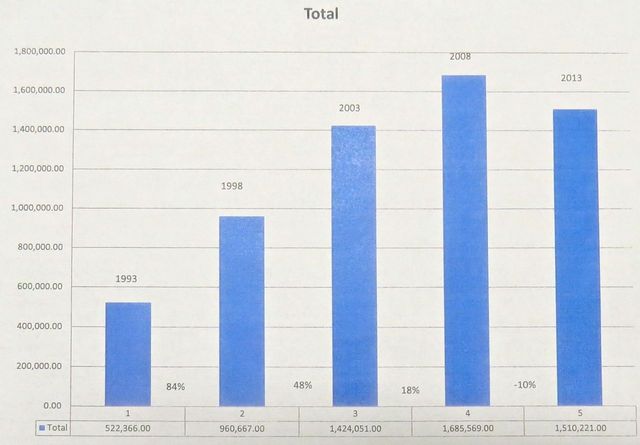

Tax Proposal Chart - 1: Revenues per 5 year increments

2014-08-20 - Photo by Tax Committee. This chart, No. 1 shows "Revenues by total per 5 year increment." It was present by the Tax Committee, three members of the Council: June Parson, Robert Flowers, and Craig Dean. It was first of 18 in the presentation narrated by Parson.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

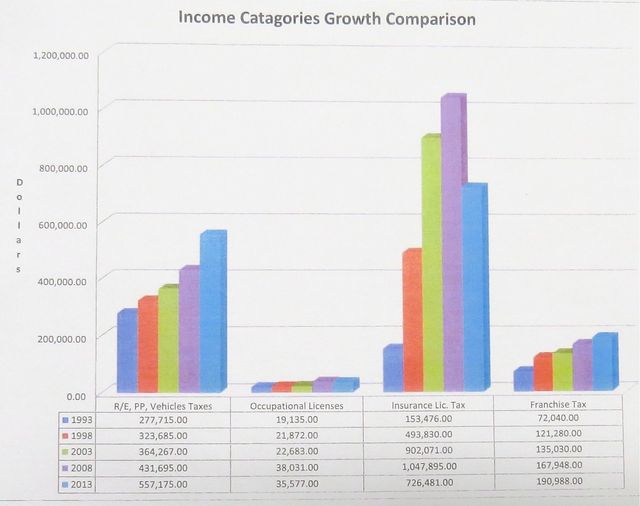

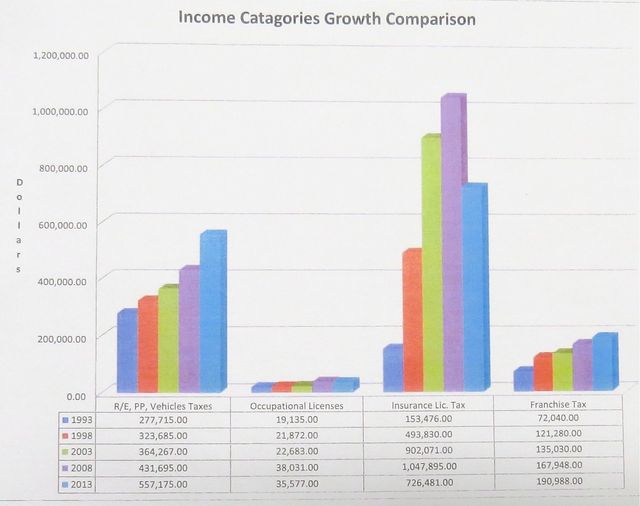

Tax Proposal Chart - 2: Revenues by Source

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. Tax Committee - June Parson, Robert Flowers, and Craig Dean - Chart Two, titled "Revenues by source" shows income categories growth comparison for the past two decades.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

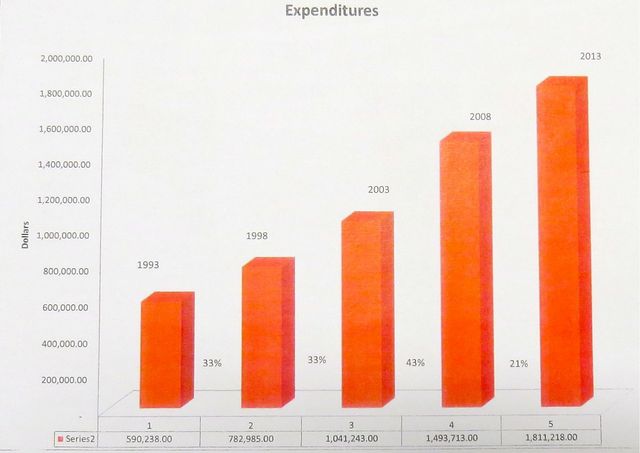

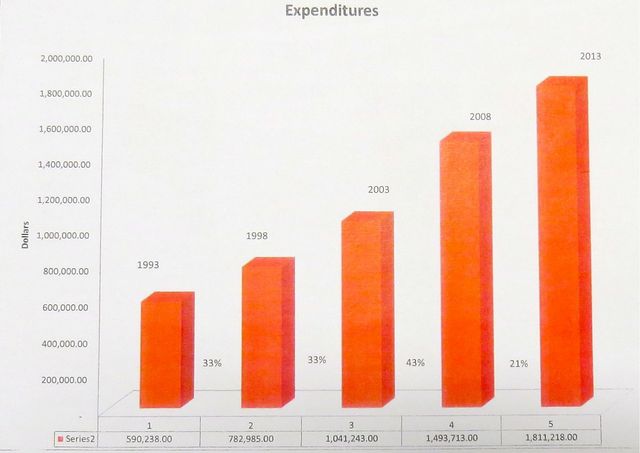

Tax Proposal Chart - 3: Expenditures by Totals 5 yr. increments

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo Tax Committee Chart. This chart shows the steady rise in expenditures in the past 20 years of City of Columbia Government, along with percentages in each time frame. The Tax Committee is composed of three Council Members, June Parson, who narrated the committee's finding, and Robert Flowers and Craig Dean.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

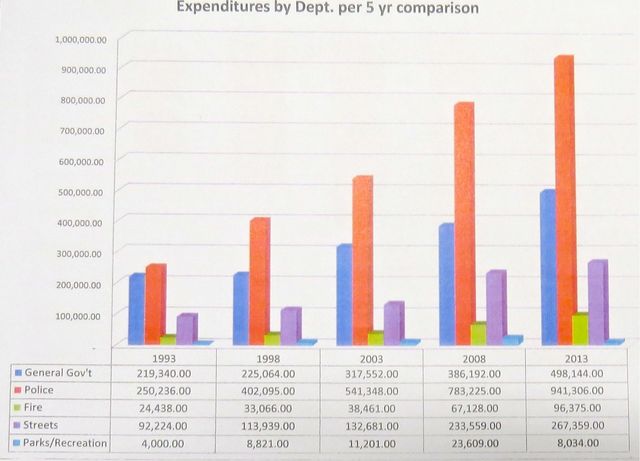

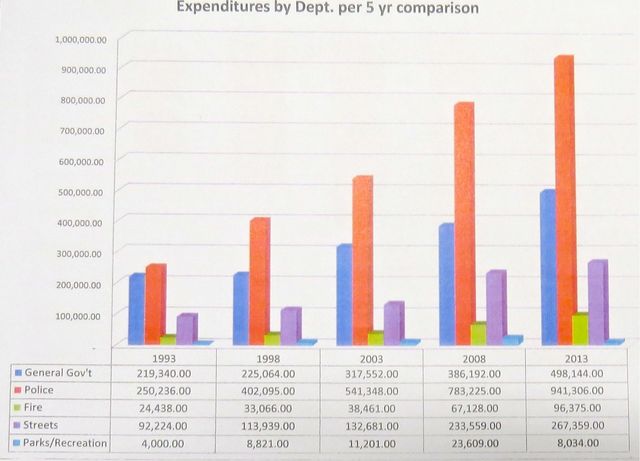

Tax Proposal Chart - 4: Expenses by dept. comparison

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo Tax Committe Chart. Council Member and Lead presenter of the Tax Committee June Parson presented this chart, showing expenditures by department in 5 year increments.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

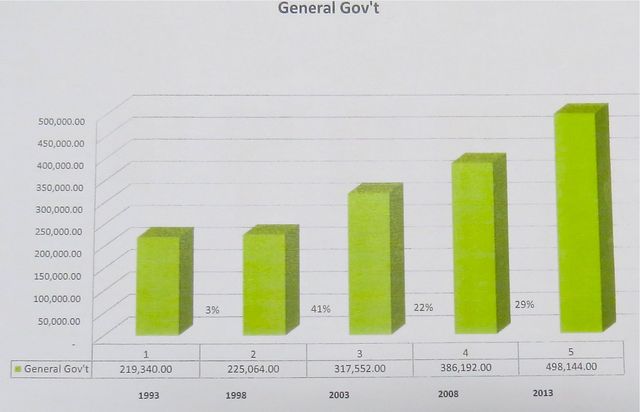

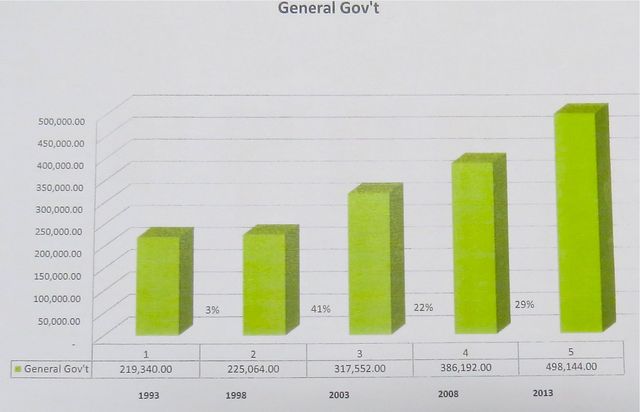

Tax Proposal Chart - 5: General Gov't

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. The Tax Committee presented this graph showing general government expenditures, with percentage increases in each 5 year increment over the past 20 years.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

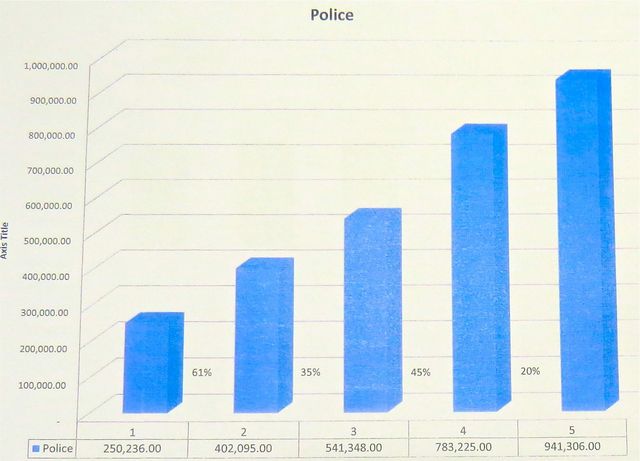

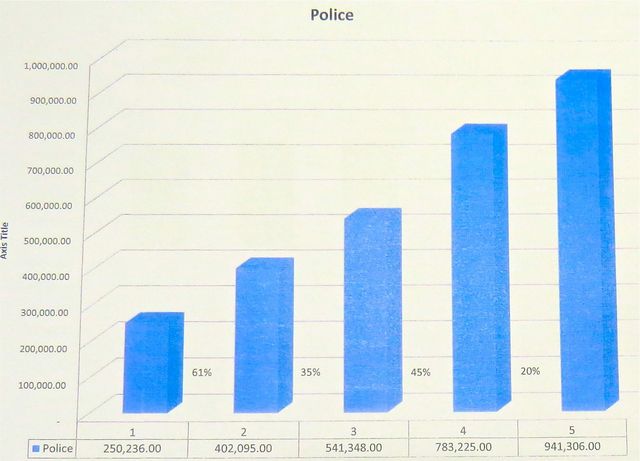

Tax Proposal Chart - 6: Police Department

2014-08-20 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. This chart shows the changes in police department expenditures over the past 20 years, 1993 (1), 1998 (2), 2003 (3), 2008 (4) and 2013 (5) for the City of Columbia, KY.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

Tax Proposal Chart - 8: Street Department

2014-08-21 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. This chart shows the changes in Street department expenditures over the past 20 years, 1993 (1), 1998 (2), 2003 (3), 2008 (4) and 2013 (5) for the City of Columbia, KY.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

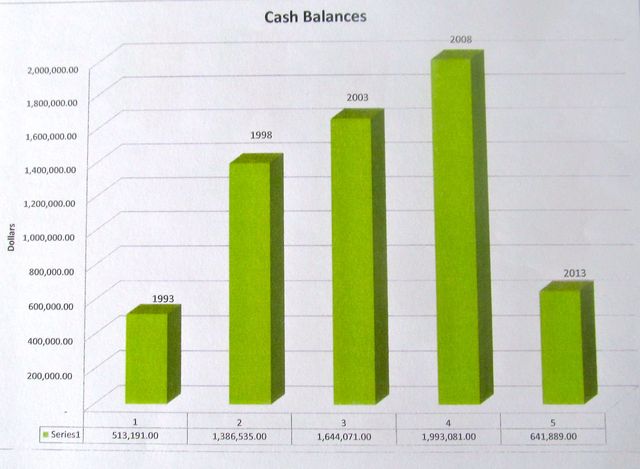

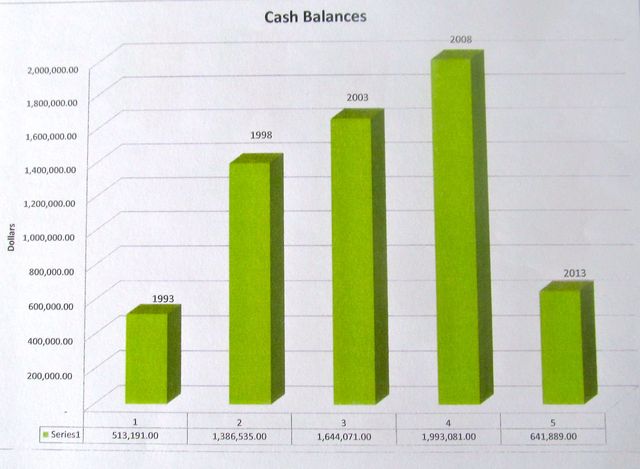

Tax Proposal Chart - 10: Cash balances 1993-2013

2014-08-21 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. This chart shows the cash balances for the past 20 years, with a steady build up of reserves and a precipitous drop in the last 4 years. Legend: 1993 (1), 1998 (2), 2003 (3), 2008 (4) and 2013 (5).

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

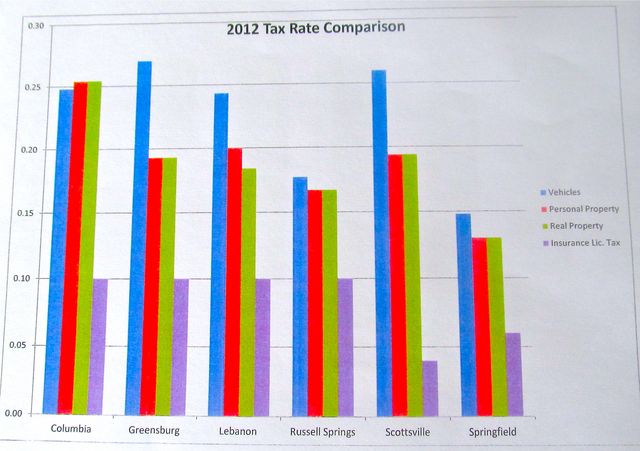

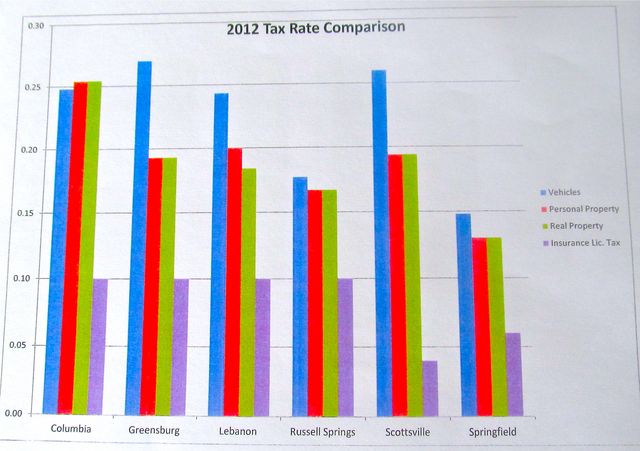

Tax Proposal Chart - 11: Taxes compared to nearby towns

2014-08-21 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee.

This chart shows how Columbia's existing tax rates for vehicles, personal property, real property compare to Greensburg, Lebanon, Russell Springs, and Springfield.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

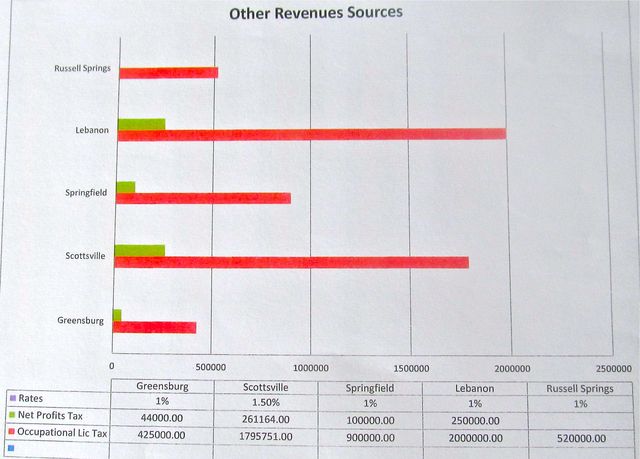

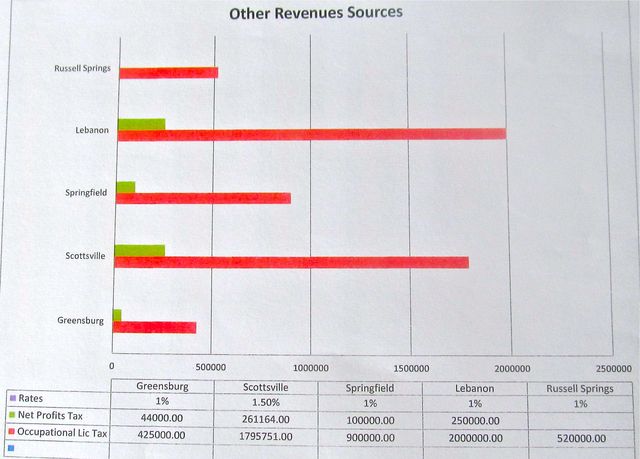

Tax Proposal Chart -12: Other revenue sources

2014-08-21 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. This chart shows how other cities are using other taxes as part of their revenue streams. It shows annual revenues derived from both net profits taxes and occupatonal license taxes (payroll tax) and rates for Greensburg, Scottsville, Springfield, and Lebanon, and for the payroll only tax in Russell Springs. The tax committee is proposing only a payroll tax in Columbia, to take effect January 1, 2014.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

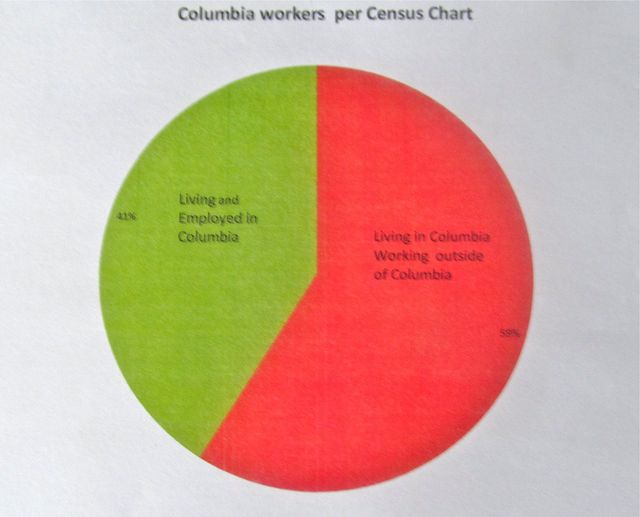

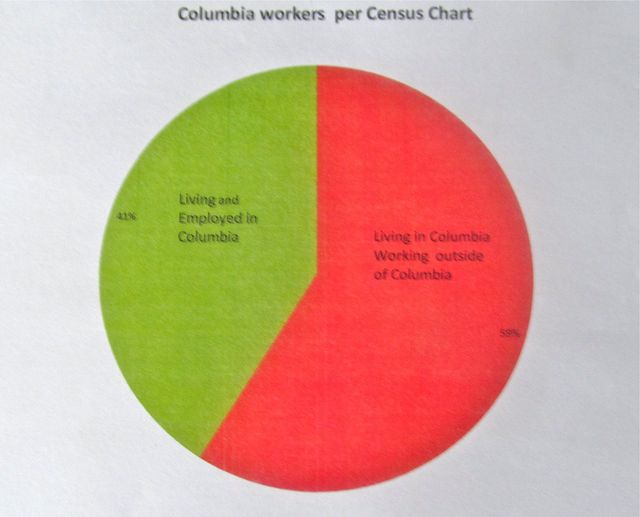

Tax Proposal Chart - 13: Census: Where Columbians work

2014-08-21 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. The pie chart above indicates that of Columbia's workforce, 41% are living and employed in Columbia, with 59% living in Columbia but are working outside of Columbia. The chart was part of the presentation by the Columbia City Council Tax Committee, June Parson, Robert Flowers, and Craig Dean.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

Tax Proposal Chart - last : Reduction in taxes

2014-08-21 - City Hall, 116 Campbellsville Street, Columbia, KY - Photo by Tax Committee. This chart was presented to show the reduction in real estate and personal costs, if the tax shift proposed by the Columbia City Council Tax Committee is adopted. While the numbers on the left hand side are correct, and there is approximately four cents on $100 of valuation reduction, the bar images would appear, on first glance, to be significant. The reduction is actually relative small, as pointed out by Rickie Williams, a Columbia property owner.

Read More... | Comments? | Click here to share, print, or bookmark this photo.

|

|

|

115 Jamestown St.

Columbia, KY.

270-384-2496

Get weather alerts for Adair County

Provided by the Adair Co Fiscal Court and the Adair Co. Emergency Mgt. Agency

|